Supply chain woes claim another victim: London Stock Exchange Group braces for tech-related shortages

10/25/2021 / By Ramon Tomey

The London Stock Exchange Group (LSEG) has warned that supply chain shortages could affect the timing of its technology-related expenditures. The exchange’s warning comes amid its acquisition of data platform Refinitiv following a steady third quarter. It also follows shortages of much-needed microchips, which play a key role in technological expansion.

While there was no change to previous cost or capital expenditure plans, LSEG said without giving further detail that “supply chain pressures may impact the timing of some technology spend this year.”

Anna Manz, LSEG’s chief financial officer, touched on the issue during a call with analysts. “We’ve seen a few weeks’ delay in the delivery of some particular tech hardware type items. It’s not impacting any of our transformation or integration project timing or any of our overarching change delivery,” she said.

Despite facing technology-related shortages, LSEG still expects its year-to-April 2022 income to grow between 4 percent and 5 percent. However, it expects a slowdown in its income for the fourth quarter compared to the third quarter of 2021.

LSEG’s shares have dropped by 17 percent since the beginning of March 2021. This drop follows the exchange’s acquisition of Refinitiv and its integration into the LSEG data and analytics unit. The exchange purchased the platform, originally a part of Thomson Reuters, in January 2021.

David Schwimmer, LSEG’s chief executive officer, said: “We are making excellent progress on the integration of Refinitiv, and are comfortably on track to achieve £125 million ($172 million) of cost synergies in 2021, ahead of our original phasing.”

Microchip shortage comes with big repercussions

LSEG joined many other companies bearing the brunt of supply chain delays. A shortage of microchips, which are important components for the tech hardware needed by LSEG, has contributed to the delays mentioned by Manz.

Apple CEO Tim Cook said back in April 2021 that the tech giant had been forced to delay production on its iMac desktop computer and iPad due to the chip shortage. Cook’s confirmation disproved the presumption of many insiders that Apple would be able to avoid the impacts of the chip shortage.

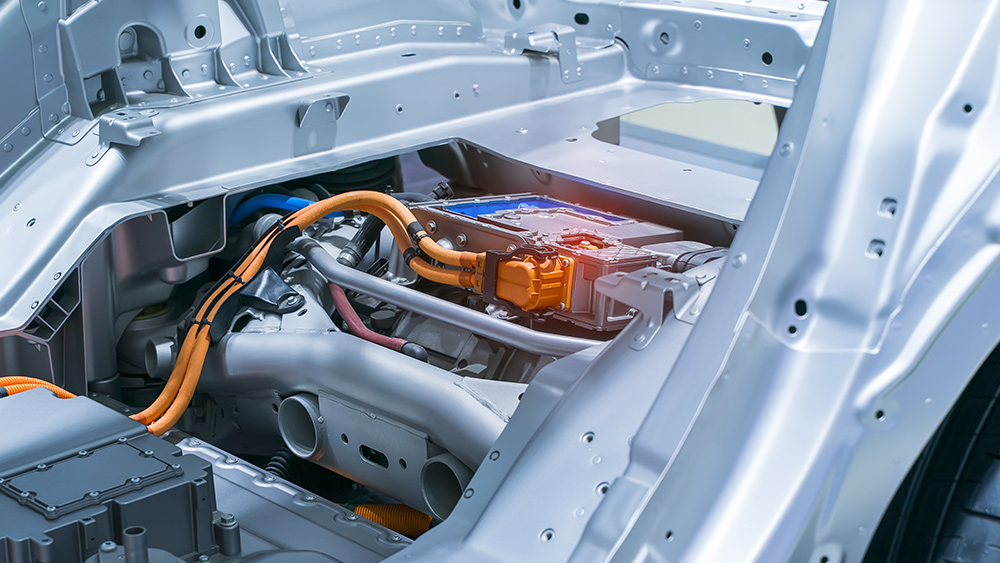

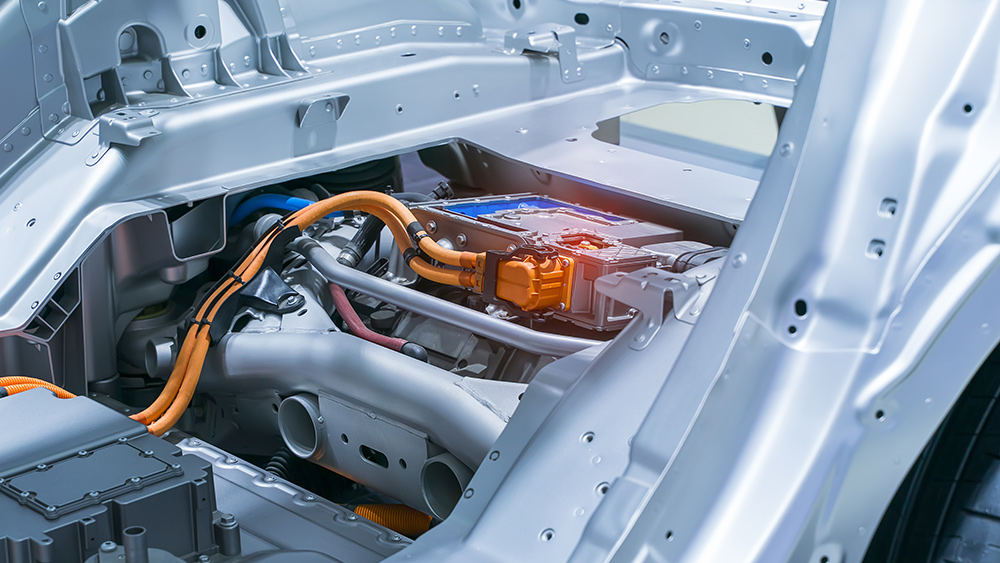

Car manufacturers have been hit the hardest by the chip shortages. New vehicles also utilize these chips for their navigation, Bluetooth and collision-detection systems. Given this, car manufacturers have been the most hard hit by the chip shortage. Consulting firm AlixPartners predicted back in January 2021 that the microchip shortage will cost the automotive industry some $61 billion in revenue. (Related: Microchip shortage affects production of new vehicles, leads to higher car prices.)

According to Business Insider, demand for microchips has gone up as many rushed to buy cars and other technologies utilizing these components. Many car manufacturers have been forced to shut down plants and prioritize the models they make. Meanwhile, car prices have continued to soar.

Tesla CEO Elon Musk also confirmed in April 2021 that the electric vehicle manufacturer was facing “insane difficulties” with its supply chain. “We’ve had some of the most difficult supply-chain challenges that we’ve ever experienced in the life of Tesla,” he told investors that month.

Meanwhile, Ford CEO Jim Farley said in April 2021 that the car company were expecting a 50 percent loss of its production for the second quarter of the year. During that month, he warned the chip shortage would worsen – with a fire that hit a chip supplier for Ford and other car manufacturers contributing to the dearth.

“There are more whitewater moments ahead for us that we have to navigate. The semiconductor shortage and the impact to production will get worse before it gets better,” Farley told investors. (Related: Ford expects car production to SHRINK IN HALF during the second quarter due to semiconductor chip shortage.)

Collapse.news has more articles about how supply chain issues affect stock exchanges.

Sources include:

Tagged Under: Apple, bubble, car manufacturers, London Stock Exchange Group, market crash, microchip shortages, products, Refinitiv, semiconductors, stock prices, supply chain, tech supply chain, technology expansion, vehicle production

RECENT NEWS & ARTICLES

FlyingCars.News is a fact-based public education website published by Flying Cars News Features, LLC.

All content copyright © 2018 by Flying Cars News Features, LLC.

Contact Us with Tips or Corrections

All trademarks, registered trademarks and servicemarks mentioned on this site are the property of their respective owners.